Brief US Expat Tax Review

Editor's Note: The following article is based on an article written by I.J. Zemelman, EA, the tax Operations Director at Taxes for Expats. This is a company based in London and New York that specializes in US expatriate tax accounting. We are offering this article as a service to our readers, both for the information in the article, and as a reference to a specialist in this area, as we know many US expatriates have tax questions and tax issues. We cannot, however, be held liable for any results that might occur in our readers' tax accounting as a result of reading this article. As with other financial issues and all medical issues, please do check with your own trusted advisers. That said, we hope you find this information useful!

Tax Issues for US Expatriates

Residing, retiring and/or working in a foreign country is an exciting prospect for many people. Aspects which are not quite as exciting, however, are the tax obligations that US expats face as a result of earning foreign income. As if US expat taxes weren’t difficult enough, regulations and reporting requirements are updated annually, making it almost impossible to repeat last year’s filing process. Understanding US expat taxes is even more difficult for expatriates who have to file a US expat tax return for the first time.

This article is not intended to be a complete tax guide to US expat taxes, but rather to highlight some of the most important aspects of US expat tax returns.

Protection against Dual Taxation

The IRS understands that part of living and working in another country is the responsibility to pay into that country’s taxation system. As such, the Internal Revenue Service has devised standard exclusions and credits for US expats to avoid having to pay income taxes twice. While there are a number of exceptions, credits and exclusions outlined in various tax treaties, there are TWO major deductions allowed to US expats to avoid dual taxation. They are the FEIE (Foreign Earned Income Exclusion) and the FTC (Foreign Tax Credit). These are not issued automatically. There is a process for claiming such credits, and they are discussed below.

Foreign Earned Income Exclusion

The FEIE, or Foreign Earned Income Exclusion, is in place to allow US expat taxpayers to deduct as much as $92,900 of all foreign earned income from their total US taxable income. For many expats, this exclusion alone is a sufficient measure to completely obliterate their tax liability to the US. However, not all first year expats will qualify for the exclusion. In order to qualify for the FEIE, an expat must meet one of two tests established by the IRS: The Bona Fide Residence Test or the Physical Presence Test. According to this article in About.com, "You are considered a "bona fide resident" of the foreign country if you reside in that country for "an uninterrupted period that includes an entire tax year." The Physical Presence Test says "You are considered physically present in a foreign country (or countries) if you reside in that country (or countries) for at least 330 full days in a 12-month period." Qualifying expats are able to claim the FEIE by filling out Form 2555 and attaching it to their US expat tax return.

Foreign Tax Credit

Applying the FTC, or Foreign Tax Credit, to your taxes can have a significant impact on your tax liability or your return amount. Because many overseas countries have a higher income tax rate than the United States, the IRS allows US expats to deduct the total amount paid in taxes to a foreign country (dollar for dollar) from their total taxable income to the US to avoid double taxation. To claim the Foreign Tax Credit, you must use Form 1116 with your US expat tax return. In our experience, many US expat taxpayers wind up paying too much or getting less back than they should from the IRS because they are not aware of these credits or how to claim them appropriately.

Reimbursements for International Cost of Living

In addition to those ways to avoid dual taxation, there are also tax credits available for working expatriates.

Foreign Housing Credit

In addition to the FEIE and the FTC, there is another credit available to qualifying US expats which allow deductions to be made in order to offset the cost of relocating to and living in a foreign country. This credit is known as the Foreign Housing Credit. The Foreign Housing credit is not only claimed on the same form (Form 2555) as the FEIE, it also has the same qualification guidelines (meeting either the Bona Fide Residence Test or the Physical Presence Test). For most US expats, the Foreign Housing Credit will be most easily determined by simply multiplying the amount of their FEIE by 30% (0.3). There are other expats, however, who may be living and working in a foreign city with an exceptionally high cost of living such as London or Paris or Mexico City. Expats living in such parts of the world should calculate their total Foreign Housing Credit by multiplying their FEIE amount by a percentage set forth by the IRS for that specific region.

Advantageously Claiming a Large Payment or Gift

Many expats are aware of the obligation to report large foreign payments such as sizable gifts, bonuses, commissions, etc., but many are unaware of the most advantageous way of claiming such payments. World currency fluctuates much like the US stock market. When it comes to claiming large payments as income, the IRS allows taxpayers to choose the method by which the exchange rate on the earnings is calculated. You have the flexibility to determine whether you want to calculate the USD equivalent of your foreign income on the day it was received or by using the annual rate. Obviously, you will want to use the lowest amount to claim on your US expatriate tax return. Depending on the day you received the payment in question, the difference could be anywhere from a couple hundred dollars to a thousand dollars or more. To give you an idea of the fluctuations, the Mexican peso was at 13.94 (pesos to the US dollar) on January 1, 2012 and was at 12.8 pesos to the US dollar on October 1, 2012. That difference can be sizeable, depending on the size of the payment you are reporting, so be sure to take the time to conduct adequate research to determine the most advantageous exchange rate for taxation purposes.

Tips for the End of the Year

There are various tax breaks and consideration of losses available to international taxpayers, so we advise taking the time and energy to consider some year-end tips that might help you maximize your US expat tax return. Here are a few end of year considerations:

Capital Gains

It’s not a big secret that capital gains taxes are assessed on investment earnings all over the world. Taxation on investment earnings, however, can be offset by claiming losses including bad trades, cost of trades and other executions, and any other cost associated with investing. It is important for taxpayers to search their investment records thoroughly to identify all losses incurred throughout the year.

Charitable Donations

If you are planning on making any donations to an IRS-approved charity organization, it is imperative that you make the donation before the end of the tax year. If you will not be able to pay the donation amount until the following year, you might consider paying with a credit card. Even though you will not be able to pay off the credit card bill until the following year, you will still have made a qualifying donation in time to claim it on the current year’s tax return.

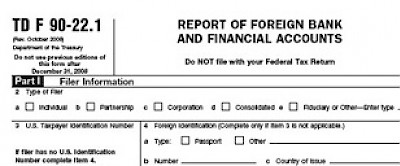

Review all Foreign Bank Accounts

It is important to keep in mind that the Foreign Bank Account Report (FBAR) filing threshold of $10K includes ALL foreign bank accounts. Make sure to review the balances of all your accounts for the entire year to determine whether or not you are required to report their activity. Failure to meet FBAR reporting requirements can lead to significant penalties in the future.

Avoid Getting Overcharged for Professional Tax Preparation

There are a great number of tax preparation services who know how confusing US expat taxes are and take advantage of their difficulty by overcharging expats for assistance. Make sure to have a complete understanding of how much you will pay for professional tax preparation before you agree to contract services. Understand that there are potentially dozens of forms that may have to be filed, so getting involved with a preparer interested in charging you for each form may be a dangerous gamble. You are much better off settling with a tax professional who will offer you a flat US expat tax preparation fee.

Mexican Tax System for American Expatriates

Mexico personal tax rates are progressive to 30%.

In 2013, this rate will decrease to 29% and beginning in 2014, personal income tax rates are set to reduce to 28%.

Mexico Personal annual tax rates for 2012

Income (MXN) % Tax

$1 - 5,953: 1.92

$5,954 - 50,525: 6.4

$50,526 - 88,793: 10.88

$88,794 - 103,218: 16

$103,219 - 123,580: 17.92

$123,581 - 249,243: 21.36

$249,244 - 342,842: 23.52

$342,843 and over: 30

Note: An alternative minimum tax, AMT, of 17.5% applies for income received and deposited into your bank in cash. Non-residents will pay 15% to 30% on their employment income in Mexico. The first $125,900 MXN is tax exempt, subject to change.

People residing in Mexico calculate their annual tax on their total income generated both in the country and abroad. In the case of foreign income, taxes paid abroad are generally credited against taxes payable in Mexico.

In Mexico, there are specific rules for each type of personal income, including wages, fees, capital gains, dividends, etc. In the case of wages, the taxes are withheld by the employer. In the case of salaries paid by a foreign company to a foreigner working in Mexico, personal taxes have to be computed and paid by the company, except when the foreign company has no branch or fixed base in the country and the person spends less than 183 days in the country during the year.

There are only a few personal expenses that a Mexican taxpayer can deduct from their income which are as follows:

- school transportation for their children (only in certain cases)

- medical and dental fees, including hospital expenses for the taxpayer, spouse, direct-line ascendants or descendents

- funeral expenses for the persons mentioned under (b) above

- donations to authorized entities

- contributions for employee retirement

- medical insurance payments

Basis - Mexican nationals and residents are taxed on their worldwide income. Nonresidents are taxed on Mexican-source income.

Residence - An individual is considered a resident if he or she has a permanent home in Mexico. If an individual has a home in two countries, the key factor is the location of his/her center of vital interests. Mexican nationals are, in principle, considered tax residents, subject to the permanent home and/or the centre-of-vital-interests test. US expatriates might have some leeway in this category, but in order to claim Mexico as a residence, must pass the aforementioned Bona Fide Residence Test or the Physical Presence Test.

Tax Filing status - Tax returns are filed individually, regardless of marital status.

Taxable income - Income is taxed, in part, under a schedule system, although some revenue can be mixed to determine taxable income. Profits derived from a trade or profession are generally taxed in the same way as profits derived by companies. An independent tax regime for interest earned by individuals went into effect on January 1, 2011.

Capital gains - Capital gains are generally taxed as income. However, gains derived from the sale of publicly traded securities or the transfer of personal property (other than corporate shares, securities and investments) are tax exempt, subject to certain rules. For instance, the profit from the sale of real estate is only exempt if the tax payer can prove residency in that property for at least two years.

Tax Deductions and tax allowances - Subject to certain restrictions, deductions are granted for medical expenses and medical insurance, retirement annuities, mortgage interest, and a few other expenses. Personal tax allowances are available to the taxpayer and his/her spouse, children and dependents.

Other Taxes On Individuals in Mexico?

- Capital duty - No

- Stamp duty - No

- Capital acquisitions tax - No

- Inheritance/estate tax - No

- Net wealth/net worth tax - No

Real property tax - City authorities levy taxes and licenses on the ownership of real property within their jurisdiction. The yearly property tax is called predial and is paid at the beginning of each calendar year. These taxes are deductible in calculating the individual's taxable income applicable to the leasing of real property.

Social security - Employed individuals are required to make social security contributions (IMSS), with the amount based on the individual's salary and deducted and paid by the employer.

Mexico tax year - Mexico tax year is the calendar year

Tax Filing and tax payment - Tax on employment income is withheld by the employer and remitted to the tax authorities. Some other types of income, such as income from the provision of services and leasing income, are also subject to withholding. Income not subject to withholding is self-assessed. In those cases, the individual must file a tax return and make prepayments of tax. Final tax is due on 30 April (no extensions are available).

Penalties - Penalties do apply for noncompliance

Finally...

A personal note from Working Gringos. Taxes are no less complicated in Mexico than they are in the United States. If you own a business in Mexico, you must file tax returns monthly, not annually. This serves to keep a lot of accountants in business, but conversely, it is also somewhat freeing. By filing monthly, the intense stress of the year-end tax filing is somewhat avoided. As an individual working in Mexico, if you work for a corporation, many of your tax liabilities are deducted and paid for you by your employer. If you make money in Mexico some other way, do be sure to check with your local accountant to be sure that you are fulfilling your Mexican residency tax obligation. And keep in mind that all of this filing and paying in Mexico does not exempt you from filing a tax return in the US, even if you don't owe a penny. In our experience, if you have any sort of complications or issues with the tax authorities in Mexico, it is a relief to have an accountant to be your representative with Hacienda (Mexico's IRS). We hope this article has served as a primer on expatriate tax issues in Mexico, and we encourage you to seek out your own accountants, both locally and in the US, to handle your own unique issues. Because we are NOT experts on this subject, we are closing comments for this article.

Mostly, we just encourage you to get and keep your affairs in order so that you can enjoy your time in the Yucatan!

*****

The writer of this article is I.J. Zemelman, EA is the founder of Taxes for Expats. She may be reached at: +1-646-397-2887 (please say that Yucatan Living sent you). You may also contact her via email at questions@taxesforexpats.com or check her website at www.taxesforexpats.com.

I.J. Zemelman's All Experts page

To understand more about the various taxes you might encounter in Mexico, we encourage you to read this