Merida Real Estate Predictions

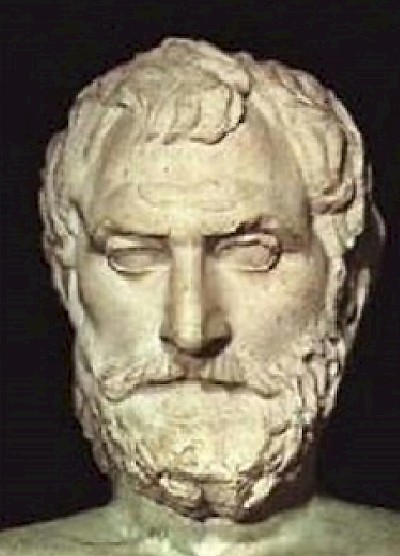

Predicting human behavior has been around since Thales simultaneously kicked off Western Philosophy, the scientific revolution, and earned the title as the world’s first true mathematician. Just what does one of the lesser-known Seven Sages of Greece have to do with future real estate values in the Yucatan? Thales loved to explain the world around him by replacing mythology and emotion with logical, scientific, and mathematical principles. Fortunately for us, Aristotle recounted the following tale of Thales, a story which involves olive presses and olive production in Chios and Miletus, giving us a glimpse of how logic and math can be used to peer into Yucatan's misty real estate future.

Thales and the Olive Presses

In part XI of Book One of Politics, Aristotle spins a yarn about a philosopher "who showed the world that philosophers can easily be rich if they like, but that their ambition is of another sort". Aristotle tells how one winter, Thales put a deposit on all the olive-presses in Chios and Miletus, which gave him exclusive use of the presses after the coming harvest.

>

Since the press owners weren't sure whether the harvest would be bountiful or a bust, Thales, secured the contracts for very low prices in what is thought of as the first known example of options trading. Aristotle also tells us that there was not one bid against him. The olive press owners believed that they were protecting themselves against a poor harvest, by guaranteeing at least some money up-front, regardless of how the harvest turned out. Good plan, eh? Go with the herd. There's safety in the herd.

So how did it turn out? An excellent harvest forced heavy demand for the presses. Since Thales held a monopoly, he rented them out at huge profits. Was he an expert olive crop forecaster? Not really. Rather, he deteremined that even a bad harvest would not lose him much from the lost deposits, while the potential profits of a good harvest far out-weighed the possibilities of small losses. Thus Thales showed the world that “philosophers can easily be rich if they like, but that their ambition is of another sort".

So what is Thales' lessons to us in the present moment? Facts, logic, and math are not just the tools of scientists and philosophers.

US Baby Boomer Demographics

For the past few years, many local expats have predicted only marginal real estate price gains here in the Yucatan, but a quick look at US demographics offers a different picture. We are fast approaching 2013, when the 1947-1948 US Baby Boomers reach official retirement age. 2013 is notable, because the number of people eligible for retirement will jump by about 10 million, from 15 million up to 25 million. This might seem like just boring facts. But if Thales were around today, he might make a different case. Here's where some simple bits of math come in.

Let's Do The Math

Since many of the eligible retirees will need to continue to work, maybe only 40% of the US Boomers will retire in 2013. Let’s say then that there will only be 10 million new retirees every year. Clearly, Mexico is not everyone's cup of tea, so maybe only 10% of those retirees will consider Mexico to stretch their retirement fixed incomes, yielding a paltry one million new retirees. Continuing on a Thalesian path, Merida is one of Mexico's top three cities for quality of living, and Merida and Yucatan's Gulf Coast offer safety, relatively low real estate prices, excellent health care, modern services, and even a growing expat population, so newcomers don't have to live like isolated pioneers. If only 5% of those one million consider visiting or living in Merida and Yucatan's Gulf Coast, that would mean roughly 50,000 new expats coming to north Yucatan every year. Are you starting to see the Thalesian opportunities?

The 25 million new Baby Boomers eligible for retirement every year will continue to drive a growing Grey Boom from 2013 to 2030. For the sake of argument, let's say these Thalesian guess-timates are high by a factor of ten. That still adds 5,000 new expats every year, swelling Yucatan's current (approximately) 10,000 expat population dramatically. In fact, that would add 50% more expats in 2013 alone. The more likely addition of 10,000 - 20,000 new expat visitor/buyers every year for the next seven to ten or more years would definitely change the Yucatan's economy and real estate opportunities. In fact, real estate in Yucatan might be similar to Arizona's & Colorado's 10X growth throughout the '70's, '80's, & '90's.

Where Will They Go?

Like Colorado's desirable mountain property, there is only so much beach property and only so much Merida Centro property. Like recent buyers, many of these new expats will fall in love with the romance of classic Spanish colonial architecture, driving the Centro market prices upward. Others will seek their beach front Shangri-La's on the Yucatan Gulf Coast.

A ten year torrent of five thousand new expats a year seems to belie some current predictions of marginal inflation of Merida and the Yucatan Gulf Coast’s real estate markets. Keeping it all in good Thalesian factual perspective, the local real estate market is coming off a few flat years for both sales and prices, which makes some people cautious, like their 600 BC olive-press-owner counterparts. These are the ones who are predicting real estate growth that only marginally keeps ahead of inflation.

Retirement Accounts

Which are you? If Thales were here today, would he argue that 25 million newly eligible retirees every year between 2013-2030 is tough to ignore, and quietly place his bets? Would he do this even though many of the potential retirees have less in their retirement accounts now due to the recent worldwide economic failure? Again, facts, logic, and math may ride to our rescue. Is it possible that the much heralded retirement portfolio losses are also ultimately a bit of a mirage?

A quick check of the major stock indexes shows recovery to their August 2008 pre-crash levels. If the current trends continue, the data show that investors will likely erase all their losses in just the next year, reaching pre-crash highs by early 2012. What does this mean for the north Yucatecan economy? If Boomers didn't panic-sell their investments, they should logically recover all of their portfolio losses before 2012.

A different logical scenario is that many people approaching retirement in 2012-2013 followed financial advisor's advice and shifted their portfolios heavily to bonds five years before retirement. This would mean that many conservative near-retirement investors had moved their money out of stocks into safer-but-lower-returning investments like bonds in 2007, avoiding the big losses. This group would still be financially on-track to retire on-time in 2013, allowing some of them to come to Yucatan. Might this be another data point that improves the 2013 outlook?

So, Nothing To Worry About, Right?

Sunshine, sunshine, and more sunshine, with only smooth sailing ahead? Not likely.

The current economic icebergs dead ahead include a few troubling points. The majority of the US State Governments (30) are reporting significant 2011 deficits that could translate into up to 2 million new lay-offs, unless US taxpayers accept higher taxes. Following Thales' example, if we guess-timate that 50% of the potential government layoffs occur, that would add one million new workers to the current ranks of the 14 million official US unemployed (a jump of 0.64%). RealtyTrac researchers reported that 2010's high unemployment drove foreclosures up by 72 percent in 206 leading metropolitan areas last year, including many which were not hit as hard by the initial foreclosure waves that pounded cities in Nevada, California and Florida. They predict that foreclosures will increase by another 20%, reaching a peak in 2011.*

These figures are troubling, in that they project yet more distressed properties being dumped onto already overloaded US real estate markets, creating yet another one year backlog of unsold homes listed at depressed prices, all needing to be worked off in 2011 and 2012. The math and data point to a US real estate market that hits bottom in 2011-2012, but then starts to improve by 2013. Yet again, that pesky 2013 date pops up.

If US real estate markets finally improve by 2013, and hidden state government debts stop driving new layoffs, then gradually increasing home prices will encourage US Baby Boomers, who will then be considering retirement abroad. The potential combination of some life in USA's 2013 future, as unemployment turns and real estate prices turn, coupled with a surge in greying Baby Boomer retirees, buoyed by fully recovered investment portfolios, bodes well for Yucatan real estate. It points to significant growth of the Yucatecan expat community between 2013 and 2030. A rapidly growing expat community would also seem to illuminate real estate opportunities now that would make Thales smile.

Whether it is 600 BC or 2011, the more things change, the more they stay the same. So now... Buy, Sell, or Hold? The ball is in your court... what will it be?

****

Bloomberg article about foreclosure futures

Comments

CasiYucateco 14 years ago

Hey Doc! :-)

I wonder if "eligible" is a key word in the equation? In other words, 1/2 the people coming up on retirement only have retirement savings of about $50,000. The rest of the "investment" is in their home. In much of the USA, at least, homes have fallen in value and 24%, roughly, of all mortgaged homes are under water.

So, while many people are becoming retirement age, a good number are not going to be able to retire and an additional good number are not going to have the funds for a cash-only home purchase transaction.

I'm not disagreeing with the conclusion, because you've certainly used very tiny percentages for projections and those numbers may very well be possible. I guess what's going through my mind is that people are really hurting now in the USA and it is hard to imagine a foreign-home buying spree of even modest dimensions.

With luck (it seems there is no educated approach being used), the downturn will lift and the world will seem rosy again. But, the longer this goes on, the more it looks like an extended economic downturn.

On Elizabeth's comment I would just note that there is no reason to "give up your health care" upon moving to Merida where health care is much more affordable and a year's worth of insurance coverage can be bought for the price of one month's coverage in the USA. Other cost of living items are relative - if you want to live like a rich person in the USA, it will cost you more in Merida. If you want to live a simple, regular life, rich with friendships and peaceful surroundings, it will cost you less to live in Merida and your life may be more rewarding.

Projecting the future is ever popular. Thanks to Dr Stephen Fry for sharing his thoughts. They give us all a jumping off point for speculation of our own! :-)

Reply

Elizabeth Hudson 14 years ago

Now, you must be wondering why we are considering buying?

It is because of a beautiful little girl that was born this year and her future siblings. Her mother was born and raised in Mexico until she was twelve before moving to the U.S.A. and then to Canada where our son was so very lucky to meet her and win her heart. They now live in California.

I would like to leave a little bit of Mexico to my grandchildren where they can visit, learn and experience the wonderful land of their ancestors, instead of buying a winter home in California, Costa Rica, Panama, etc.

Yes, I have concerns and most of them I have listed, but my heart and gut say go for it…if we can find a place in our price range (under $50,000.). My head doesn’t understand it.

We don’t make impulse decisions, we were lucky to retire early (still under 60) so we can enjoy our winter home for more years than most retirees. We spent the winter of 2011 (4 months) in Progreso, we visited Merida more times than I can count….we walked, and walked and walked. We understand the risks and are prepared for ownership for a long, long time. Profit does not enter the picture, nor should it. We looked at our numbers, and it is doable.

I am learning Spanish, and look forward to learning about Yucatan culture, I want to make a difference and therefore will volunteer and serve my neighbours, but I know that I will always be an outsider.

So, our circumstances are different from most retirees.

Perhaps, I will change Grumpy into Chuckles :) with the help of some Mexican sunshine.

Reply

Elizabeth Hudson 14 years ago

Dear Dr. Frey:

Sorry, I sounded so pessimist, but it is in my nature – my nickname is Grumpy, not Chuckles.

Now to your question – I have no idea? I broke my crystal ball a long time ago.

But here are some things to consider:

You posted a pdf. file that was written in 2006, it is now five years out-of- date and though it was interesting it really doesn’t say much. I have more questions than answers, it appears to be a slide show for a presentation and I would have loved to have attended that meeting.

It doesn’t address what you really need to know such as:

ï‚· What is the percentage of retirees in the sunshine states that plan to retire outside of the country and why? Most retirees in warm states I guess will stay there, so strike them off the list.

 How many Americans not born in the U.S.A. are planning to retire to the place of their birth? Where exactly were they born – India, China, Africa, South America, Canada, Europe etc.? Now strike everyone who wasn’t born in Mexico off the list?

 What is the estimated yearly income of the average retiree? How much has the average retiree put away? What is the average yearly pension expected for each retiree? How much is the private and government pension? If they don’t have enough strike them off the list.

ï‚· How much are they willing to spend on a house? How many can afford a long term vacation?

I have lots of questions (life expectancy, rates of serious illness, etc.) but, the Number 1 question you want to know is - What is the estimated number of retirees planning to retire to Mexico in particular Merida? Well, you they and I simply don’t know?

The world is a big place, Merida has competition for the pool of retirees wanting to buy, or, at least spend the winter away. Watch House Hunters International. This pool isn’t only from the U.S.A. and your pdf. doesn’t take this into account. Your numbers just increased -yeah!

I don’t give much credence to spreadsheets, projections, or mass media for they can put any slant they want on it, add useless info or leave out valuable information. We all must keep an open mind, do our research and go with our gut.

What has Merida got to offer seniors, what will hold them there, make them keep coming back? What is Merida doing to attract retirees?

It is not a senior friendly city the sidewalks are uneven, narrow, the lighting at night is bad, it’s overcrowded and noisy. I read about the heat, and the mosquitoes. And Mexico has a really bad reputation…yes, I know the Yucatan doesn’t see itself as part of Mexico. But, now I’m reading about gangs in Merida – how safe is it?

So, my question to you is – Why the interest in housing prices? Do you own property and want to make a tidy profit before heading home? Do you want to feel pride in making a good financial investment? Are you making plans to invest in more properties? Are you in for the long haul?

The thing about rising property values is that it usually signals an increase in everything else – housing goes up and so does food etc. Profit comes when something goes up faster than everything else - and you sell that item. If you sell then leave, you can be sure that your profit in pesos won’t go very far elsewhere.

I go back to real estate diversity. You can’t just focus only on snowbirds. They grow old and die and then the real estate market tanks.

Merida must put together a plan that places home ownership into its people’s hands. It must attract young people willing to set up shop and a home in the city. There must be a master plan over seen by honest visionaries who have the greater good of the community in mind, not lining their own pockets – they are hard to find! Manufacturing, tourism, quality of life issues and so much more…only then will you have a healthy city.

The world is not a nice place right now, and I don’t see it changing for the better in the long run. Governments can’t keep spending and building up debt. There comes a time to pay the piper. History shows us that it usually doesn’t end pretty…the Great Depression was broken by a nasty war. Rome fell.

I hope I am wrong, I pray I am wrong.

P.S. Ending on a happier note hubby and I hope to be back in Merida in September looking for a place in the sun – we like to go against the trends…perhaps we will meet.

Reply

Dr. Steven Fry 14 years ago

Hi Elizabeth,

Good points.

Your insights and analyses make excellent sense for right now in 2011. Do you think things will be the same by 2014 in the US and Canadian housing markets?

My projections of significant numbers of properties (5,000 or more) bought by expats in 2014 - 2030, requires only 1 retiree out of every 11,500 elegible retirees to decide they want some property here. This means if just 0.009% make the choice, then it that fulfills the projection.

If just 1 retiree out of 2,300 decides to visit here, it makes 25,000 new visitors a year who will need rental housing, because there is a coming flood of 58 million new US retirees becoming elegible for retirement from 2012 - 2030. These figures use Official US Census Data and Reports: http://www.census.gov/population/www/socdemo/age/2006%20Baby%20Boomers.pdf

Is it reasonable to think that 1 out of every 2,300 retirees might come visit Merida?

I don't know. But if Thales approach works, with just 1 out of every 11,500 eligible retirees, then people who own property here could be smiling.

Reply

Elizabeth Hudson 14 years ago

Having read with interest your article, my only comment is, is that Thales only had Mother Nature to contend with.

It was very much like playing the futures market say with oranges and wheat. Except a good harvest means lower share prices. I am sure Thales was not thought of in a kindly manner by those who had to pay higher prices for olive oil (brings to mind oil companies doesn’t it).

A healthy real estate market does not rely only on one market segment but rather must be able to pull from a larger pool of buyers. Prices rise when there is supply and demand. Expecting the baby boomers to fuel the market and increase prices is being foolish. Retirees with enough in their retirement fund to buy are just not there, because of a number of factors – Mother Nature is only making them older and closer to the grave!

I’ll give a few examples but these are not the only ones:

-The U.S.A. housing market has tanked, many retirees in Canada and the U.S.A. were relying on their home’s value to fund a comfortable retirement, now many Americans owe more on their mortgage than their house is worth, in Canada housing prices have simply not gone up in most cities. So the money isn’t there and because you have to live somewhere, home is as good a place as any. When you die there is no hassle selling and clearing up the estate for your family. Besides the price for a decent home in Merida is so expensive that most retirees just can’t afford it – they can buy foreclosure homes in the sunny states for half the price of a fixer upper in Merida.

-The world is so unsettled right now. The stock market is in a tailspin one day and up the next, you’re lucky to make even a small profit, your broker is making more than you, and he’s crying too. Then there are world events that make one want to dig a hole and not come out for a couple of years.

-It’s a nice place to visit but would you really want to live there? Moving to a land where another language is spoken and the culture is so foreign seems crazy to most retirees. To do so means you to lose your healthcare benefits, your family is far away, and the feeling of familiarity and comfort isn’t there – you will never really be accepted by the home grown population. Just as new Mexicans don’t really feel at home in the U.S.A

-Prices…I mentioned housing prices but didn’t mention food, gas, healthcare, clothing, medicines, household goods, vacations, air travel, etc. All are through the roof, so just where is the money going to come from?

-Governments are talking about raising the retirement age to 70. That’s five more years to see those baby boomers. At 70 do you think they’ll still feel the same about moving to Mexico?

Thales could afford to retire to Egypt on his earnings, if he hadn’t spent it on his daily living expenses. It would have been interesting to ask him if he thought housing prices would increase in Merida and if he’d leave the comfort of home for a foreign land (Oh, I forgot, the Americas hadn’t been discovered yet).

So there it is again…It’s anyone’s guess. Flip a coin or keep the coin in your pocket.

Reply

« Back (10 to 15 comments)